ACA Premium Subsidy Cliff After the New 2025 Trump Tax Legislation

[Rewritten on July 5, 2025 after the new 2025 Trump tax law was passed.]

As a result of I’m self-employed and I’m beneath 65, I purchase medical insurance from a medical insurance market established beneath the Inexpensive Care Act (ACA). Each state has one. Some states run their very own. Some states use the federal healthcare.gov platform.

Earlier than ACA got here into impact in 2014, getting healthcare protection was a giant problem for individuals with out employer-provided medical insurance. Overlook about the associated fee — simply getting a coverage was a problem in itself. ACA modified all that. Now, the self-employed, early retirees, and others who don’t get medical insurance by means of their jobs can purchase medical insurance from the ACA market for his or her state.

Not solely can you purchase medical insurance, however the protection can be made extra inexpensive by a subsidy within the type of a Premium Tax Credit score (PTC). How a lot tax credit score you get is calculated off of your modified adjusted gross earnings (MAGI) relative to the Federal Poverty Stage (FPL) to your family measurement. The decrease your MAGI is, the much less you pay for medical insurance web of the tax credit score.

MAGI for ACA

Your MAGI for ACA is mainly:

- Your gross earnings;

- minus pre-tax deductions from paychecks (401k, FSA, …)

- minus above-the-line deductions, for instance:

- pre-tax conventional IRA contributions

- HSA contributions

- 1/2 of self-employment tax

- pre-tax contributions to SEP-IRA, solo 401k, or different retirement plans

- self-employed medical insurance deduction

- pupil mortgage curiosity deduction

- plus tax-exempt muni bond curiosity;

- plus untaxed Social Safety advantages.

Wages, 1099 earnings, rental earnings, curiosity, dividends, capital features, pension, withdrawals from pre-tax conventional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond curiosity and untaxed Social Safety advantages additionally rely within the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t enhance your MAGI for ACA.

Aspect word: There are lots of totally different definitions of MAGI for various functions. These totally different MAGIs embody and exclude totally different elements. We’re solely speaking concerning the MAGI for ACA right here.

2021-2025: 400% FPL Cliff Modified to a Slope

Your premium tax credit score goes down as your MAGI will increase. Up by means of the 12 months 2020, the tax credit score dropped to zero when your MAGI went above 400% of the Federal Poverty Stage (FPL). In case your MAGI was $1 above 400% of FPL, you’ll pay the total premium with zero tax credit score. Folks needed to be very cautious in monitoring their MAGI to verify it didn’t go over the cliff.

Legal guidelines modified throughout COVID. This cliff grew to become a slope for 5 years, from 2021 to 2025. The tax credit score continued to drop as your MAGI elevated, nevertheless it didn’t all of the sudden drop to zero when your earnings went $1 over the cliff.

Eradicating the cliff was an enormous aid to individuals with an earnings larger than 400% of FPL ($81,760 in 2025 for a two-person family within the decrease 48 states). The tax credit score additionally elevated at earnings ranges beneath the cliff throughout these 5 years.

The Cliff Returns in 2026

The brand new 2025 Trump tax regulation — One Large Lovely Invoice Act — didn’t prolong the slope therapy or the extra tax credit score after 2025. The 400% FPL cliff is scheduled to return in 2026. The premium tax credit score will even drop again to pre-COVID ranges at incomes beneath 400% of FPL.

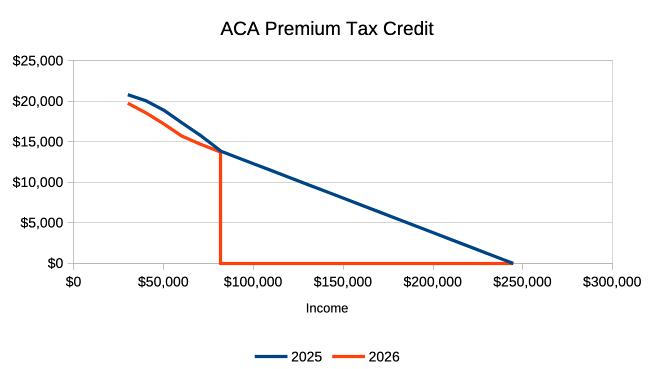

The chart above exhibits the ACA premium tax credit score at totally different incomes for a family of two 55-year-olds within the decrease 48 states, with the typical medical insurance prices throughout all states. The blue line is for 2025 with the slope and the improved tax credit score. The purple line is for 2026 with the cliff and the sundown of the improved tax credit score.

How a lot change you will note in 2026 is dependent upon the place you’re within the chart.

In case your earnings is to the left of the cliff within the chart, your tax credit score will drop barely. It goes down from about $18,900 to about $17,200 for the 12 months at a $50k earnings on this instance. A $1,700 drop within the tax credit score interprets into a rise of about $140/month to your medical insurance.

In case your earnings is to the far proper within the chart, your tax credit score will even drop, however you’ve the earnings to afford it. At a $200,000 earnings on this instance, the tax credit score drops from about $3,800 to $0, elevating the associated fee to your medical insurance by a little bit over $300/month.

The drop is precipitous instantly to the correct of the cliff. We’re speaking about receiving over $13,000 in tax credit score in 2025 versus $0 in 2026 for a two-person family with an earnings of $85k.

The information for the chart got here from a calculator created by KFF. You may enter your particular zip code, family measurement, and age on this calculator to see how a lot your premium tax credit score and your web medical insurance premium will change in 2026.

Know Your Cliff

How do you give you $13,000 further for medical insurance with an earnings of $85,000? You should handle your earnings to maintain it from going over the cliff. The very first thing to know is the place precisely the cliff is.

For a family of a single individual within the decrease 48 states, the 400% FPL cutoff is $62,600 in 2026. For a family of two individuals within the decrease 48 states, the cutoff is $84,600 in 2026. See Federal Poverty Ranges (FPL) For Inexpensive Care Act for the place the FPL is to your family measurement. Multiply it by 4 to get your cliff.

Handle Your Earnings

The following most important half is to challenge your earnings all year long and to not understand earnings willy-nilly earlier than you do the projection. If you happen to discover your earnings is near the cliff earlier than you understand earnings, you may nonetheless regulate. Many individuals are caught abruptly solely once they do their taxes the next 12 months. Your choices are rather more restricted after the 12 months is over.

If earnings from working will push your MAGI over the cliff, possibly work rather less to maintain it beneath.

Early retirees have some management over staying beneath the cliff once they depend on an funding portfolio for earnings. If you end up beneath 59-1/2, you’re primarily spending cash out of your taxable accounts. A big a part of the cash withdrawn is your personal financial savings; the remaining is curiosity, dividends, and capital features. Spending your personal financial savings isn’t earnings. If you happen to withdraw $60k from a taxable account to dwell on, your MAGI isn’t $60k. It’s in all probability lower than $30k.

Once you’re over 59-1/2, tax-free withdrawals from Roth accounts don’t rely as earnings.

Check out the MAGI definition. Reduce something that raises your MAGI, and maximize every little thing that lowers your MAGI.

When you’ve self-employment earnings, you’ve the choice to contribute to a pre-tax conventional 401k and IRA. These pre-tax contributions decrease your MAGI, which helps you keep beneath the 400% FPL cliff.

Select a high-deductible plan and contribute the utmost to an HSA. The brand new 2025 Trump tax regulation made all Bronze plans HSA-eligible beginning in 2026.

Then again, Roth conversions, withdrawals from pre-tax accounts, and realizing capital features enhance your MAGI. You need to be cautious with doing these whenever you’re making an attempt to remain beneath the 400% FPL cliff.

Speed up Earnings to 2025

If you happen to’re vulnerable to going over the cliff in 2026, take into account accelerating some earnings to 2025 when the premium tax credit score continues to be a slope. If pulling earnings ahead to 2025 helps you keep beneath the cliff in 2026, the discount within the premium tax credit score out of your further earnings in 2025 will probably be a lot lower than the steep drop in 2026.

Borrowing

In case your want for additional cash is barely non permanent, take into account borrowing as a substitute of withdrawing from pre-tax accounts or realizing giant capital features. Spending borrowed cash doesn’t rely as earnings.

As a substitute of promoting shares and pushing your self over the cliff by the realized capital features whenever you purchase a brand new automobile, take a low-APR automobile mortgage to stretch it out. HELOC and security-based lending are additionally good sources for borrowing.

You may repay the mortgage whenever you don’t want as a lot money or whenever you now not use ACA medical insurance.

Earnings Bunching

If you happen to can’t keep away from going over the 400% FPL cliff, take into account earnings bunching. Once you’re already over the cliff, you would possibly as nicely go over large. Withdraw extra from pre-tax accounts or understand extra capital features and financial institution the cash for future years.

Spending the banked cash doesn’t rely as earnings. Going over the cliff large time in a single 12 months might provide help to keep away from going over once more for a number of years.

100% and 138% FPL Cliff

There may be one other cliff on the low facet, though that one is definitely overcome when you’ve got pre-tax retirement accounts.

To qualify for a premium subsidy for purchasing medical insurance from the ACA trade, you will need to have earnings above 100% of FPL. In states that expanded Medicaid, you will need to have your MAGI above 138% of FPL. This map from KFF exhibits which states expanded Medicaid and which states didn’t.

The minimal earnings requirement is checked solely on the time of enrollment. When you get in, you’re not punished in case your earnings unexpectedly finally ends up beneath 100% or 138% of FPL. The brand new 2025 Trump tax regulation added necessities to Medicaid for reporting work and group engagement. You don’t need to have your earnings fall beneath 100% or 138% of FPL and be topic to these reporting necessities in Medicaid.

If you happen to see your earnings is vulnerable to falling beneath 100% or 138% FPL, convert some cash out of your Conventional 401k or Conventional IRA to Roth. That’ll elevate your earnings above 100% or 138% of FPL.

Say No To Administration Charges

If you’re paying an advisor a share of your belongings, you’re paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

Leave a Reply