Query of the Day: What % of People purchased requirements utilizing Purchase Now Pay Later within the final yr?

Purchase Now Pay Later presents comfort, however it might come at a price. Discover out which era depends on it essentially the most.

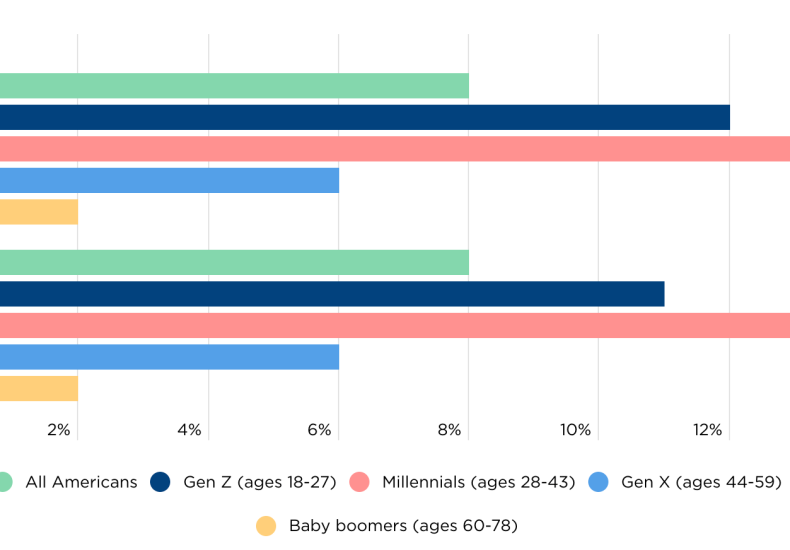

Reply: 8%

Questions:

- The place have you ever seen the choice to buy with Purchase Now Pay Later? Have you ever used it?

- Why would possibly somebody use Purchase Now Pay Later for requirements (eg. groceries, payments, private care gadgets)?

- What’s a danger of utilizing Purchase Now Pay Later for requirements?

Listed here are the ready-to-go slides for this Query of the Day that you should use in your classroom.

Behind the numbers (Nerdwallet):

“One-fourth (25%) of People used BNPL previously 12 months, in accordance with the survey, with youthful generations and oldsters among the many teams extra more likely to make use of the service. Properly over one-third (37%) of oldsters of minor kids have used BNPL previously 12 months, in contrast with 20% of nonparents of minors. And 40% of Gen Z (ages 18-27) and 36% of millennials (ages 28-43) have used BNPL throughout that point, in contrast with simply 20% of Gen X (ages 44-59) and 12% of child boomers (ages 60-78). “

“Credit score tip: For those who depend on BNPL as a result of your credit score prevents you from getting a conventional bank card, you may contemplate getting a secured card. As a result of these playing cards require that you simply put down a refundable safety deposit upfront, which turns into your credit score restrict, they are often simpler to get and forestall you from amassing unmanageable debt. Nonetheless, in case you’re struggling to cowl the prices of requirements, the required deposit makes this a purpose to work towards, maybe seeding the cardboard after a windfall akin to a tax refund or present.”

About

the Writer

Kathryn Dawson

Kathryn (she/her) is worked up to hitch the NGPF staff after 9 years of expertise in training as a mentor, tutor, and particular training instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in training from Brooklyn School. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking initiatives, strolling round her Seattle neighborhood along with her canine, or lounging in a hammock with a ebook.

Leave a Reply