How To Report 2024 Mega Backdoor Roth In H&R Block (Up to date)

[Updated on January 29, 2025 with screenshots from H&R Block Deluxe downloaded software for the 2024 tax year.]

A Mega Backdoor Roth is completely different from a daily Backdoor Roth. It’s carried out by making non-Roth after-tax contributions to a 401k-type plan earlier than transferring it to the Roth account inside the 401k-type plan or taking the cash out (with earnings) to a Roth IRA.

It’s a good way to place extra cash right into a Roth account with out having to pay a lot extra tax. Not all plans enable non-Roth after-tax contributions however some estimated that 40% of individuals can do it.

Suppose you probably did a Mega Backdoor Roth final 12 months. You need to have acquired a 1099-R kind out of your 401k plan supplier. You’ll have to account for it in your tax return. Right here’s tips on how to do it in H&R Block tax software program. If you happen to use TurboTax or FreeTaxUSA, please see:

Use H&R Block Obtain

The screenshots on this put up are from H&R Block Deluxe downloaded software program. The downloaded software program is each cheaper and extra highly effective than the web model. A person reported getting an error from the web model of H&R Block in remark #8. The H&R Block downloaded software program didn’t give that error.

If you happen to haven’t paid on your H&R Block on-line submitting but, you should purchase H&R Block downloaded software program from Amazon, Walmart, Newegg, or Workplace Depot and swap to the downloaded software program. If you happen to’re already too far alongside together with your entries, make this your final 12 months of utilizing the web model and swap to the downloaded model subsequent 12 months.

Inside the Plan Or To Roth IRA

You are able to do the mega backdoor Roth in two methods — convert inside the plan or withdraw to a Roth IRA. Changing inside the plan is far simpler, and plenty of plans automate the method. Transferring to a Roth IRA additionally works. See the earlier put up Mega Backdoor Roth: Convert Inside Plan or Out to Roth IRA?

Right here’s the situation we’ll use for example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(ok). By the point you transformed the cash to the Roth account inside the plan or transferred it to your Roth IRA, your contributions earned $200. You transformed $10,200 to your Roth account.

I’m utilizing 401(ok) as a shorthand. It really works the identical in a 403(b). If you happen to did a break up rollover — after-tax contributions to a Roth IRA and the earnings to a Conventional IRA — and the plan administrator issued one 1099-R on your two rollovers, you’ll want to separate your 1099-R into two. See One 1099-R Kind for Two Rollovers in TurboTax and H&R Block.

1099-R Entries

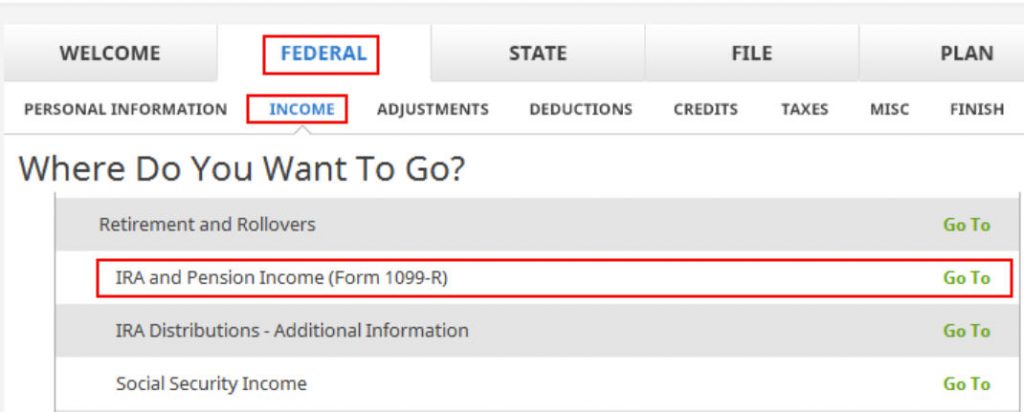

Go to Federal -> Earnings -> IRA and Pension Earnings (Kind 1099-R). You may import the 1099-R or enter it manually. I’m displaying handbook entries.

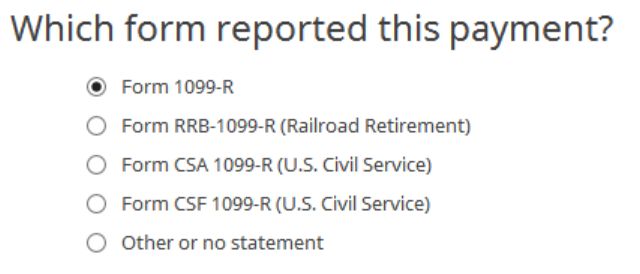

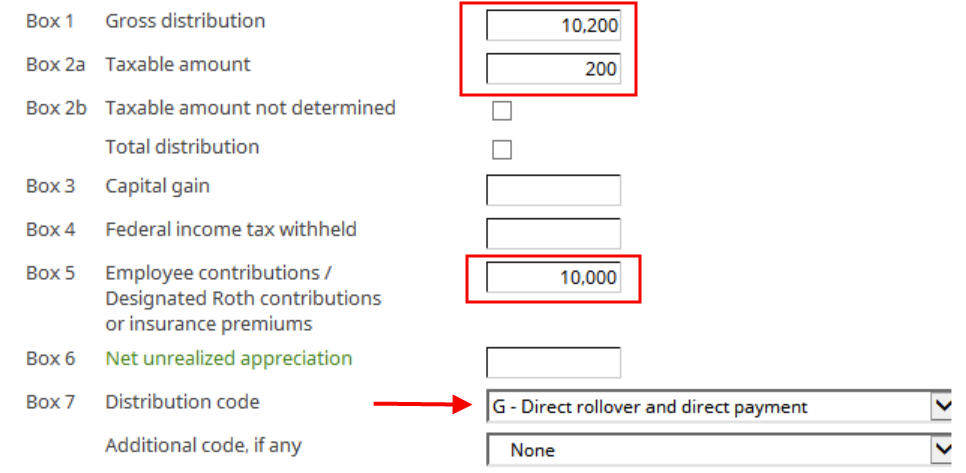

Our 1099-R is a traditional 1099-R. Enter the numbers out of your 1099-R as-is. Ours appears like this:

The gross quantity transformed to the Roth account exhibits up in Field 1. The earnings are in Field 2a. If you happen to didn’t have earnings in your rollover, Field 2a is zero. “Taxable Quantity Not Decided” below Field 2b is left unchecked. The quantity of your non-Roth after-tax contributions exhibits in Field 5. Field 7 has code G.

The IRA/SEP/SIMPLE field in Field 7 in your 1099-R ought to NOT be checked.

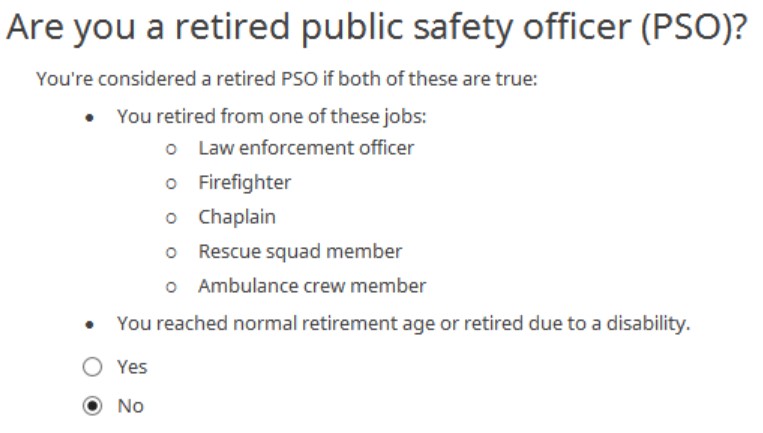

We’re not a retired public security officer.

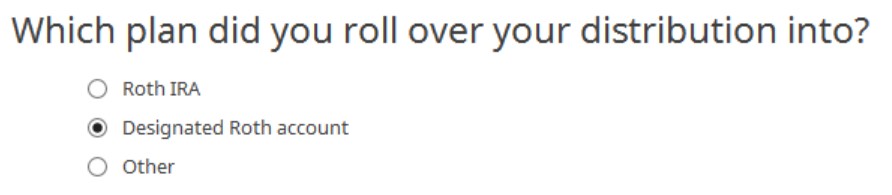

Rollover Vacation spot

The Roth 401k account is formally a “designated Roth account” within the plan. Select “Designated Roth account” for those who transformed inside the plan. Select “Roth IRA” for those who took the cash out of the plan to your Roth IRA.

That’s it. It’s so simple as that.

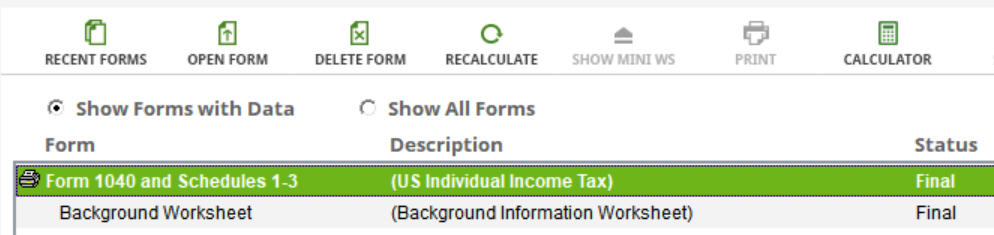

Confirm on Kind 1040

Now we confirm we’re taxed solely on the $200 in earnings, and never on the $10,000 non-Roth after-tax contributions.

Click on on “Varieties” within the high menu bar. Double-click on “Kind 1040 and Schedules 1-3” within the kinds listing and click on on “Conceal Mini WS.”

Scroll down to search out Line 5. The gross quantity transferred to the Roth account exhibits on Line 5a. Line 5b exhibits you’re taxed solely on the earnings. If you happen to didn’t have earnings, Line 5b might be zero.

While you’re carried out wanting on the kind, shut the kinds window to get again to the interview.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

Leave a Reply