Tag: Year

The 25-26 NGPF Academy 12 months is Right here!

NGPF Academy is a FREE complete skilled growth program designed to assist you acquire confidence educating private finance abilities and construct neighborhood with others who’re dedicated to bettering monetary schooling. The NEW NGPF Academy 12 months began July 1 and runs by means of June 30, 2026. Many because of the practically 5,500 academics who participated within the 24-25

What Occurs When You Save Each $5 Invoice for a Yr?

Picture Supply: Pexels Saving each $5 invoice you come throughout for a full yr would possibly sound like a small problem. However it may result in surprisingly massive outcomes. This straightforward, cash-based financial savings trick has gained recognition as a result of it’s simple to stay to and the outcomes are tangible. Simply by being

Facet hustles so widespread with millennials and gen Z, even individuals making $100,000 a 12 months have one

Virtually half of millennials and era Z are contemplating getting a ‘ facet hustle ‘ to achieve their monetary targets, based on a brand new research by Capital One Canada. The research, which surveyed greater than 1,000 Canadians, discovered that 36 per cent of these in the identical cohort (aged 18 to 44) have already

A 12 months of Limitless Health Lessons for simply $0.50!

Don’t miss this HOT deal on a Get Wholesome U TV membership! You may get a whole YEAR for simply $0.50!! {And remember to take a look at my 6 tricks to discover the motivation to work out each morning!} Get Wholesome U TV App Deal — Simply $0.50! Proper now, Get Wholesome U TV

Math Monday: End the 12 months Sturdy

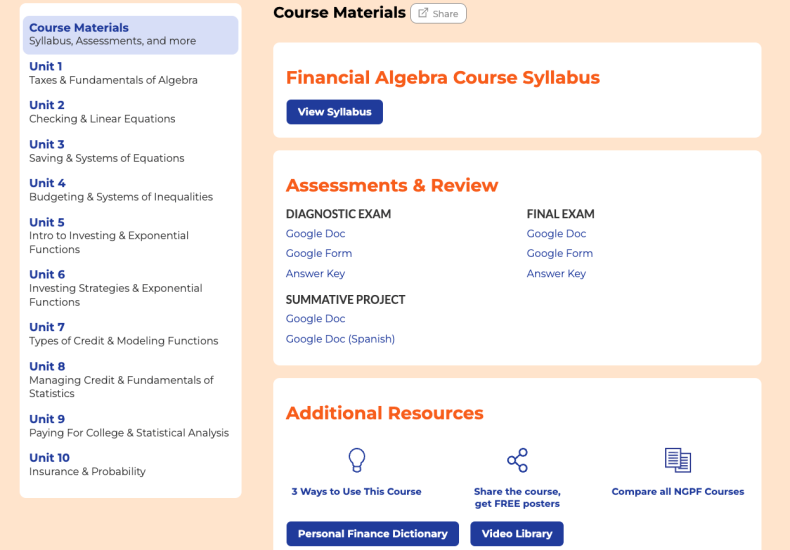

Right here’s a fast information to assessments, actions, and PD to simplify the top of the college 12 months. Finish-Of-12 months Assessments Diagnostic and Last Discover ready-to-go assessments on the Monetary Algebra Course web page. The Monetary Algebra Course consists of each a diagnostic and closing examination. Twenty multiple-choice questions on private finance content

Get A Head Begin On Your Glow-Up: Good Magnificence Ideas For The New 12 months

Get a Head Begin on Your Glow-Up: Good Magnificence Ideas for the New 12 months Why wait till January to embrace the “New 12 months, New You” mindset? True transformation takes preparation, and Barbie’s Magnificence Bits guides you each step of the way in which. We’ll information you thru confirmed methods for radiant pores

Cut up-Yr Backdoor Roth IRA in H&R Block, Yr 1

Up to date on January 28, 2025, with up to date screenshots from H&R Block Deluxe obtain software program for the 2024 tax yr. If you happen to use TurboTax or FreeTaxUSA, see: One of the best ways to do a backdoor Roth is to do it “clear” by contributing for and changing in the identical

Break up-Yr Backdoor Roth IRA in H&R Block, Yr 2

Up to date on January 28, 2025, with up to date screenshots from H&R Block Deluxe obtain software program for the 2024 tax yr. In case you use TurboTax or FreeTaxUSA, see: The earlier submit Break up-Yr Backdoor Roth in H&R Block, 1st Yr handled contributing to a Conventional IRA for the earlier yr or recharacterizing a earlier

New 12 months, New Nails: The Greatest Nail Tendencies To Attempt This 12 months

New 12 months, New Nails: The Greatest Nail Tendencies to Attempt This 12 months Nail artwork is not nearly vogue; it is about self-expression. From glitzy chrome finishes to mood-reflective aura nails, the most recent nail developments are making waves for 2025. Whether or not you are inquisitive about timeless classics or futuristic nail designs,

Recharacterized within the Identical 12 months

[Updated on January 29, 2025 with updated screenshots from H&R Block Deluxe desktop software for the 2024 tax year.] You will have contributed to a Roth IRA after which realized later within the 12 months that you’d exceed the earnings restrict. You recharacterized the Roth IRA contribution as a Conventional IRA contribution and transformed it

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |