Tag: Year

Magnificence Traits To Begin Off The 12 months

Magnificence Traits to Begin Off the 12 months: Finest Face Lotions, Style Ideas & Nail Traits Introduction: What are magnificence developments for 2025 Keep forward of the curve this winter season with our curated roundup of magnificence and elegance necessities. From barrier-strengthening moisturizers to good layering strategies and trending nail designs, prime magnificence and trend

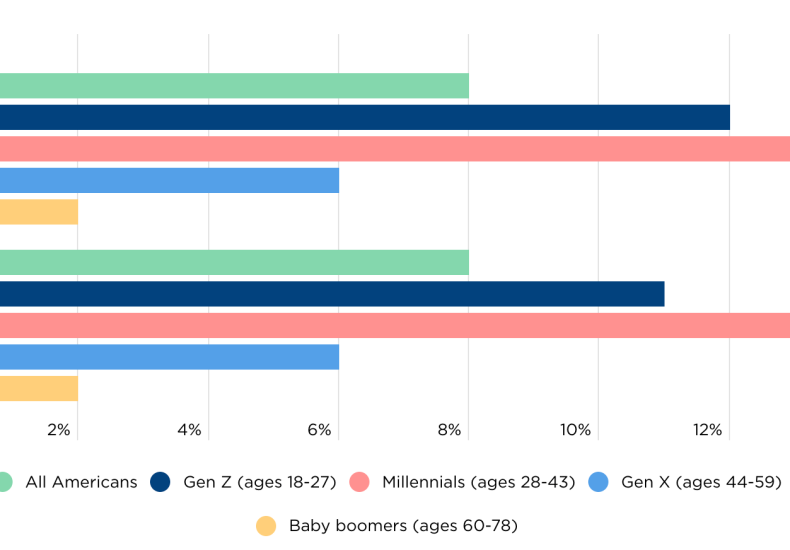

Query of the Day: What % of People purchased requirements utilizing Purchase Now Pay Later within the final yr?

Purchase Now Pay Later presents comfort, however it might come at a price. Discover out which era depends on it essentially the most. Reply: 8% Questions: The place have you ever seen the choice to buy with Purchase Now Pay Later? Have you ever used it? Why would possibly somebody use Purchase Now Pay Later

Recharacterize & Convert, Similar 12 months

You could have contributed to a Roth IRA after which realized later in the identical yr that you’d exceed the revenue restrict. You recharacterized the Roth IRA contribution as a Conventional IRA contribution and transformed it to Roth once more earlier than the tip of the yr. Your IRA custodian despatched you two 1099-R varieties,

Break up-12 months Backdoor Roth IRA in FreeTaxUSA, 12 months 1

[Updated on January 30, 2025 with updated screenshots from FreeTaxUSA for the 2024 tax year.] One of the best ways to do a backdoor Roth is to do it “clear” by contributing *for* and changing in the identical 12 months — contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and

Break up-12 months Backdoor Roth IRA in FreeTaxUSA, 12 months 2

[Updated on January 30, 2025 with screenshots from FreeTaxUSA for the 2024 tax year.] The earlier submit Break up-12 months Backdoor Roth IRA in FreeTaxUSA, 12 months 1 handled contributing to a Conventional IRA for the earlier yr and recharacterizing a earlier yr’s Roth IRA contribution as a Conventional IRA contribution. This submit handles the conversion half in

Fortunate Nails: St. Patrick’s Day Nail Appears To Strive This Yr

Fortunate Nails: St. Patrick’s Day Nail Appears To Strive This Yr St. Patrick’s Day is all about celebrating luck, attraction, and a complete lot of inexperienced! Whether or not you’re heading to a festive parade, grabbing drinks with associates, or simply embracing the vacation spirit, a themed manicure is the proper strategy to full your